Things about Eb5 Investment Immigration

Things about Eb5 Investment Immigration

Blog Article

The 9-Minute Rule for Eb5 Investment Immigration

Table of ContentsThe Facts About Eb5 Investment Immigration RevealedThe Ultimate Guide To Eb5 Investment ImmigrationEb5 Investment Immigration - An OverviewEb5 Investment Immigration Fundamentals ExplainedThe Ultimate Guide To Eb5 Investment Immigration

While we strive to use accurate and up-to-date web content, it must not be considered lawful guidance. Migration laws and laws are subject to alter, and private conditions can differ widely. For personalized advice and lawful advice regarding your certain migration scenario, we highly recommend speaking with a qualified immigration attorney who can give you with customized assistance and make sure conformity with present regulations and regulations.

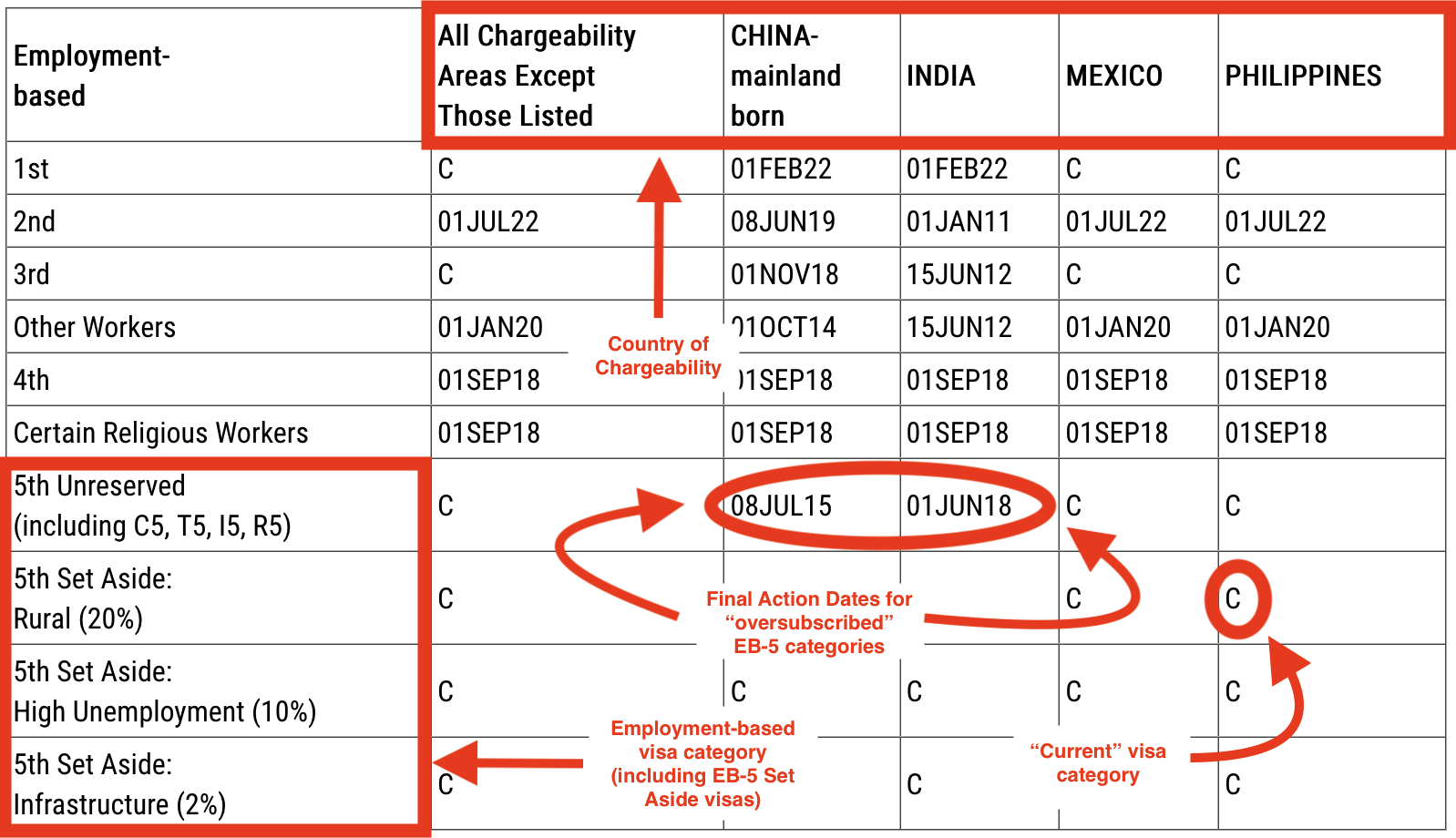

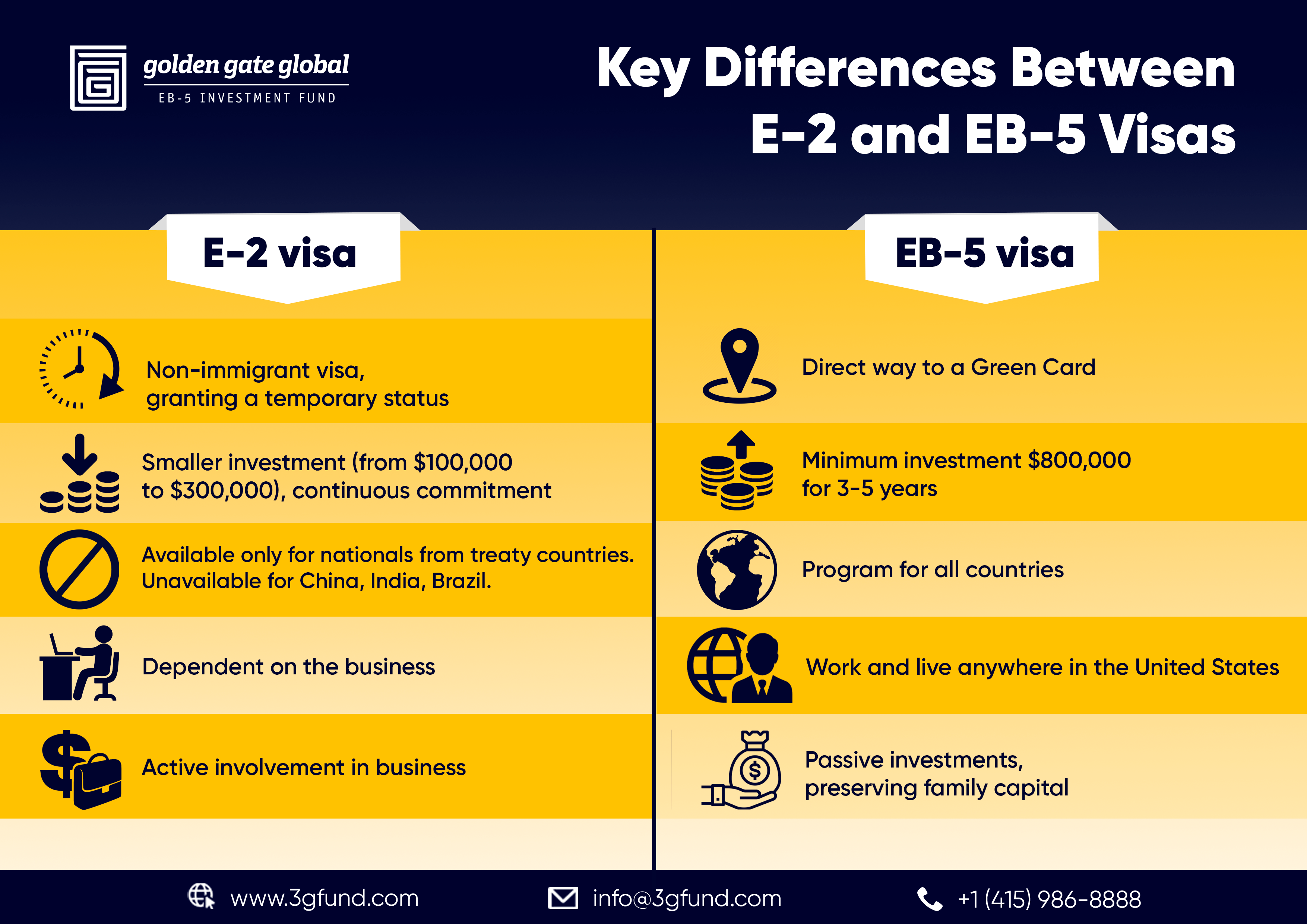

Citizenship, through financial investment. Presently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Areas and Backwoods) and $1,050,000 in other places (non-TEA zones). Congress has authorized these amounts for the following 5 years starting March 15, 2022.

To certify for the EB-5 Visa, Investors should produce 10 permanent united state jobs within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that investments add directly to the U.S. work market. This uses whether the tasks are developed directly by the company or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

Some Known Details About Eb5 Investment Immigration

These jobs are established via models that use inputs such as advancement prices (e.g., building and equipment expenditures) or annual profits produced by ongoing procedures. In contrast, under the standalone, or straight, EB-5 Program, just straight, permanent W-2 employee positions within the company may be counted. A key danger of relying exclusively on direct employees is that staff reductions because of market problems might result in insufficient full-time positions, possibly bring about USCIS rejection of the financier's request if the job production need is not satisfied.

The financial version then forecasts the variety of direct work the brand-new company is most likely to create based upon its anticipated earnings. Indirect work determined through financial designs describes work created in industries that supply the goods or services to business straight entailed in the task. These work are created as a result of the boosted demand for products, materials, or services that support the business's procedures.

What Does Eb5 Investment Immigration Mean?

An employment-based fifth choice category (EB-5) financial investment visa supplies a method of ending up being a permanent united state local for international nationals hoping to spend capital in the United States. In order to request this permit, an international investor needs to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or protect a minimum of 10 full time work for United States employees (excluding the investor and their prompt household).

Today, 95% of all EB-5 resources is increased and spent by Regional Centers. In numerous regions, EB-5 investments have loaded the financing space, giving a brand-new, crucial source of Recommended Site resources for local economic advancement jobs that renew communities, create and support tasks, framework, and solutions.

About Eb5 Investment Immigration

employees. In addition, the Congressional Budget Plan Office (CBO) racked up the program as earnings neutral, with administrative expenses spent for by applicant charges. EB5 Investment Immigration. Greater than 25 nations, consisting of Australia and the UK, usage comparable programs to attract foreign financial investments. The American program is more strict than several others, requiring significant risk for investors in terms of both their financial investment and migration standing.

Family members and individuals who look for This Site to relocate to the United States on a long-term basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Provider (U.S.C.I.S.) set out different needs to obtain permanent residency via the EB-5 visa program.: The very first step is to discover a qualifying financial investment chance.

As soon as the chance has actually been determined, the investor must make the investment and send an I-526 application to the U.S. Citizenship and Migration Services (USCIS). This petition has to include evidence of the financial investment, such as financial institution declarations, purchase agreements, and service strategies. The USCIS will certainly examine the I-526 request and either accept it or request extra proof.

The 25-Second Trick For Eb5 Investment Immigration

The financier should request conditional residency by sending an I-485 request. This request needs to be submitted within 6 months of the I-526 approval and must consist of proof that the investment was made and that it has produced at least 10 permanent tasks for united state employees. The USCIS will assess the I-485 request and either approve it or demand extra evidence.

Report this page